The financial crisis, which began in the United States in 2007 and exploded the following year as a global recession, has affected all Western countries, including Italy, whose economy previously experienced a condition of relative fragility. due to low growth and difficulties in adjusting to global transformations. The country, through timid fluctuations, from 2008 to 2014 has not, in fact, emerged from a condition of recession, and among the main European economies it is the one that finds it most difficult to restart on a growth path. The effects are visible in the public accounts, with the public debt exceeding 132% of GDP in 2013, and, above all,

Since the beginning of the crisis, the Italian GDP has recorded a fluctuating trend and, after a drastic decline in the first years, there was minimal growth in the first and second quarter of 2011, and then decreased for an entire semester, continuing negative also for the whole of 2012 and for 2013, documenting an even worse state of recession than the other states in the euro area of southern Europe. In 2014, the growth of the Eurozone countries, albeit contained, also gave positive signals in the countries that had been on the verge of default (Spain and Greece) until recently (Spain and Greece), while in Italy a condition of stagnation of the economy still continues.

According to TRANSPORTHINT, the decline in GDP per capita in absolute terms is an even more evident measure of the Italian economy: in 2014 there were $ 35,284 apiece, $ 4246 less than in 2008. Despite the permanent crisis, this is a average income per resident which confirms a leading role for Italy, which remains among the eight world economic powers (G8) and is a member of the G20. It maintains a high level of human development, albeit decreasing (26th place worldwide with 0.872, in 2013, below the average for OECD countries).

These aggregated data on a national scale, however, conceal the relevant differences in the social and regional distribution of wealth. According to an estimate by SVIMEZ, the GDP of the South fell by 13.3% in the period 2007-13 (−7% in the rest of Italy) and should still be decreasing in the years to come, in the face of a recovery of the central-northern regions. Over the last decade, the various social categories have registered very different income dynamics: if, on the one hand, workers and employees have seen a significant reduction in incomes, with consequent drops in consumption, managers and entrepreneurs have been much less affected by austerity. According to Censis, the 10 richest men in the country have assets equal to that of nearly 500,000 working-class families combined. In 2013, according to ISTAT data, 12.6% of families (3,230,000) were in a condition of relative poverty and 7.9% (2,028,000) were in absolute terms. Such conditions worsen in the southern regions. The same inequalities can be read in the unemployment values, a rate that doubled from 6.1% in 2006, reaching 12.7 in 2014, with the regions of Calabria, Sicily and Campania with values above 20%.

Railway and motorway network

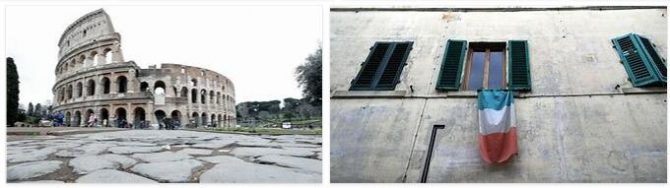

The outsourcing of the economy was consolidated in the first years of the new millennium, representing 73% of the added value and occupying 68% of the assets. In particular, tourism (I. is the fifth most visited country in the world, with the largest number of sites declared World Heritage Sites by UNESCO), trade and services are the backbone of the national system. The crisis has hit all productive sectors, starting with agriculture, with a slowdown that also affects multifunctional farms (the boom that characterized the farm is far away). The crop specializations, on the other hand, continue to ensure market niches: Italy remains in the lead in Europe for excellence in agri-food productions as a number of PDO (Protected Designation of Origin) and PGI (Protected Geographical Indication), as well as having the record for the number of organic farms (49,700 in 2012). The main sectors of the production structure have all been hit hard by the crisis: shipbuilding, primary steel, household appliances, chemical-pharmaceutical, metallurgical, textile, clothing, fashion and automotive, the latter with FIAT which is still an almost monopolistic company. FIAT, the country’s industrial icon, has also undergone transformations: completing the merger with the American Chrysler in 2014, it became FCA (Fiat Chrysler Automobiles), a company incorporated under Dutch law which has London as its tax office. This company has progressively disengaged itself from industrial production in Italy: at the end of 2011 the Termini Imerese plant was closed and, in general, it went from about 44,000 employees in the auto sector in 2003 to less than 23,000 at the beginning of 2015. The widespread structure of small and medium-sized enterprises, which characterizes the Italian industrial sector, has also been hit by the crisis, to which it has often reacted through production relocations. Overall, in the period 2009-13, according to the study center of the CNA (National Confederation of Crafts and Small and Medium Enterprises), there were over 1.7 million closed businesses, with a significant share of artisan businesses. At the same time, the resistance to the crisis of some of the made in Italyjewels (especially the agri-food and haute couture brands) meant the loss of national ownership: from 2008 to 2012, 437 Italian companies were acquired by foreign companies. The opportunities for a recovery starting from 2015 do not seem linked only to the reactivity of the real economy, but also to the possible reform actions of the country’s overall system, which has been hit in recent years by episodes of corruption and expansion of criminal action also in central areas, as demonstrated by the investigations of the judiciary from 2012 to 2014 (MOSE, Experimental Electromechanical, of Venice, Expo of Milan, corruption in Rome).